NX Filtration N.V. (Euronext Amsterdam: NXFIL), the global provider of breakthrough direct nanofiltration (dNF) technology for pure and affordable water with strong sustainability benefits, today reports its consolidated financial statements for 2021 with accelerating revenue growth and strong strategic progress.

2021 highlights

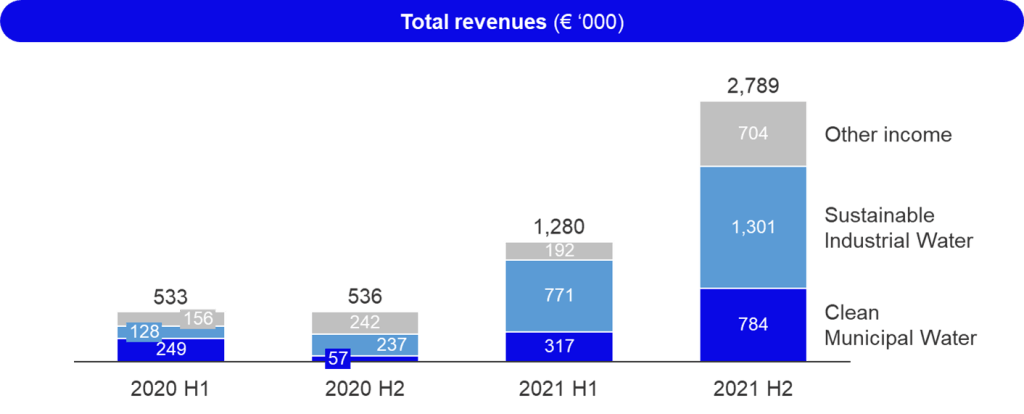

- Total revenues[1] of €4.1m, an increase of 281% compared to 2020, outperforming the >€3.7m outlook as communicated at IPO and HY results

- Strong acceleration in the second half of 2021, with a year on year growth in total revenues of 420% in H2 2021 compared to H2 2020

- Further uptake of pilot strategy with more than 3 times more pilot projects than in 2020, supported by a growing fleet of pilot systems (85 at the end of 2021 compared to 18 at the end of 2020)

- Strong and measurable ESG impact: contributing to our mission ofclean water for all (e.g. enabling 121 billion liters of clean water[2]), avoiding emissions at our customers (enabling 2,127 ton CO2e savings[3]) and realising progress on our internal initiatives. All dNF sales contribute to the EU Taxonomy, based on objective 1 on climate change mitigation

- Important new project and customer wins, amongst which PepsiCo, Aqualia, Veolia, Aigües de Barcelona and Grundfos, as well as successful repeat projects with our OEM customers, amongst others PT. Bayu (Indonesia), Aquarius H2O Dynamics (India) and Nijhuis Saur Industries (Netherlands / France)

- Growing international presence through an expanding sales force (new sales presence in the USA, Canada, India, Singapore and UAE) and a growing OEM network. 66% of revenues from sale of goods were generated outside Europe compared to 24% in 2020

- Executive team extended with CFO Marc Luttikhuis, who started in January 2022 and CCO Alejandro Roman Fernandez, who started in September 2021

- On-track for capacity expansion: second membrane spinning production line commissioned and construction of new megafactory for the production of dNF membranes expected to start on schedule in H2 2022

- Outlook on total revenues of €8m to €10m for 2022, driven by strong market demand and expanding global sales presence, enabled by the increase in production capacity. Targeted sales growth largely driven by past and ongoing pilot projects that are converting into larger scale projects and by repeat business with our existing (OEM) relationships

Michiel Staatsen, CEO of NX Filtration, states:

“2021 was a year of making strong impact for NX Filtration: strong increase in revenues, with rapid acceleration in the second half of the year across all aspects of our strategic agenda and realising real and measurable ESG impact through our mission of clean and affordable water for all.

We successfully listed our company on Euronext Amsterdam and became the first green-labelled IPO. We are experiencing increasing traction in the market with our direct nanofiltration membranes, that can remove micropollutants (including pharmaceuticals, medicines and PFAS) in one-step whilst offering our customers strong sustainability benefits by reducing energy consumption and avoiding the use of pre-treatment chemicals.

At the same time, we are accelerating progress on our strategic expansion plans. We further ramped-up our pilot program and we experience a significant increase in the conversion of pilot projects to larger scale projects. I am proud to be working with many, mostly new, customers, amongst which PepsiCo, Aqualia, Veolia, Aigües de Barcelona and Grundfos. We also see our strategy of repeat projects gaining traction, such as with PT. Bayu, Aquarius H2O Dynamics and Nijhuis Saur Industries. We strengthened our organisation with a new CFO and CCO and expanded our international sales presence in Asia, North America and the Middle East.

At the end of 2021 we added a second membrane production line in our existing facilities, that will enable us to accommodate growing demand. We are also making significant progress with the development of our new megafactory for nanofiltration membranes, for which we expect to start construction in the second half of 2022.

For 2022, we have an outlook on total revenues of between €8m and €10m, driven by strong market demand and our expanding global sales presence, enabled by the increase in production capacity. This targeted growth is largely driven by past and ongoing pilot projects that are converting into larger scale projects and by repeat business with our existing OEM relationships.”

Financial and segmental review

Total revenues increased by 281% from €1,069k in 2020 to €4,069k in 2021. Especially the second half of 2021 showed a rapid acceleration of growth, with an increase in total revenues of 420% from €536k in H2 2020 to €2,789k in H2 2021.

Key drivers for this growth were an increase in the number of pilot projects as well as full-scale projects that resulted from preceding pilot projects. In addition, we benefitted from the start of our contract with Hydranautics to produce and supply HYDRAcap ultrafiltration (UF) modules (with a gradual ramp-up in volumes during 2021), the expansion of our sales force to new countries (USA, Canada, India, Singapore and UAE) and a growing number of (repeat projects from) OEM relationships.

We experienced our strongest growth in the Sustainable Industrial Water business line, with revenues from the sale of goods of €2,072k in 2021 (€771k in H1 2021 and €1,301k in H2 2021), a growth of 468% compared to €365k in 2020. NX Filtration benefitted from the pilots it had initiated since mid-2020 and the relatively short lead-times from pilots to full-scale projects. We experienced strong traction with customers in, amongst others, the food & beverage, textile and paper industries looking to reduce their water footprint and optimise their water systems in a sustainable way.

Key projects included a repeat project for Nijhuis Saur Industries for industrial water treatment in France, multiple projects for Aquarius H2O Dynamics for wastewater reuse in the textile industry in India and the supply of our dNF modules to Grundfos focusing on industrial water footprint reduction. In addition, NX Filtration worked with PepsiCo to investigate additional opportunities for deployment of dNF membranes within PepsiCo’s facilities, following previous use of dNF technology at two PepsiCo facilities in North America.

In the Clean Municipal Water business line, revenues from the sale of goods in 2021 were €1,101k (€317k in H1 2021 and €784k in H2 2021), a growth of 260% compared to €306k in 2020. This growth was primarily driven by full-scale projects in Asia, whereas the focus in Europe and North America has been on realising pilots with leading players, with visibility on future large projects.

We realised repeat projects with PT. Bayu for the production of drinking water in Indonesia, supplied our dNF modules to Aquarius H2O Dynamics for caustic clarification at an effluent treatment plant in India, and received an order from EcoAzur for a new wastewater treatment project in Mexico. In the European and North American market, where the conversion time from pilot to demo or full-scale projects typically takes longer, NX Filtration started various new pilot projects, amongst others with Veolia in France, Aigües de Barcelona in Spain, Service de l’Eau de Lausanne in Switzerland, Jacobs for the City of Melbourne in Florida, USA and various water utilities, amongst whom PWN, Aa & Maas and WMD, in the Netherlands.

Other income was €896k in 2021, a growth of 125% compared to €398k in 2020. Growth in other income was driven by rental income from a growing number of pilot projects and government grants for innovation projects.

Gross margin increased from 47.9% in H1 2021 to 58.7% in H2 2021. H1 2021 gross margin was, amongst others, impacted by waste resulting from the HYDRAcap UF product introduction at the start of the year. Gross margin for the full year 2021 was 55.0%, slightly lower than in 2020 (56.9%) as a result of, amongst others, a changing product mix with a growing share of UF products and production inefficiencies related to a relatively high number of product switches on a single membrane spinning line. The latter is being addressed with the addition of our second high-capacity spinning line that was commissioned at the end of 2021, which will also accommodate the further growth of our business.

Personnel costs increased by 115% to €3,833k compared to €1,781k in 2020. Total FTEs increased from 34 at 31 December 2020 (43 at 30 June 2021) to 69 at 31 December 2021, with key additions in sales force, pilot engineers, R&D employees and production personnel.

Other operating costs (excluding costs related to the IPO) increased by 162% to €2,546k compared to €971k in 2020. Costs related to the IPO amounted to €9,585k.

EBITDA loss (excluding costs related to the IPO) was €3,738k in 2021 compared to a loss of €1,972k in 2020. EBITDA loss including costs related to the IPO was €13,323k in 2021. Net loss (excluding costs related to the IPO and corresponding tax effect of €2,334k) amounted to €4,103k compared to a net loss of €2,092k in 2020. Net loss including costs related to the IPO was €11,354k in 2021.

Capex amounted to €8,616k as compared to €1,454k in 2020. Capex included investments in the ongoing capacity expansion (new production facility for module production and expansion of the production facility for membrane production) and the expansion of NX Filtration’s fleet of pilot systems. Additionally, NX Filtration capitalised €741k of development costs which demonstrates the company’s continued efforts to invest in innovations for the future.

Net cash position at 31 December 2021 amounted to €133,433k, compared to a net cash position of €6,599k at 31 December 2020. This increase is the result of the equity capital that NX Filtration raised through its IPO in June 2021.

Working capital[4] decreased to €1,062k as per 31 December 2021 versus €1,300k at 31 December 2020.

Operating cash flow (excluding costs related to the IPO) was €3,631k negative in 2021, compared to €2,620k negative in 2020. Operating cash flow including costs related to the IPO was €13,215k negative in 2021.

Sustainability and ESG impact

Sustainability and a clear Environmental, Social and Governance (ESG) agenda are at the heart of NX Filtration’s business. We passionately believe we have a responsibility to contribute positively to society and the environment. 2021 marked an important year for NX Filtration in terms of progress on this ESG agenda: we realised an externally certified green-labelled IPO, professionalised our CO₂ emission data collection in order to be able to report thereon, prepared for ISO14001 certification (which we obtained at the start of 2022), realised further alignment with the UN Sustainable Development Goals (SDGs) and can already report that all our dNF sales contribute to the EU Taxonomy, based on objective 1 on climate change mitigation[5]. We are also strongly committed to contribute to other objectives of the EU Taxonomy for which the delegated regulations including the technical screening are still under development.

We have developed a targeted ESG framework in which we address and monitor our impact along three pillars:

- Clean water for all: Our 2021 membrane sales can enable the production of 121 billion liters of clean water[6], which is equivalent to the drinking water supply for 22 million persons during one year. In 2021, NX Filtration enabled access to clean water across 28 countries.

- Avoiding emissions at our customers: With our membrane module sales in 2021, we enabled 2,127 ton CO2e savings during the deployment lifetime of our membrane modules, by avoiding the use of 3.9 million kg of chemicals and saving 49 GWh energy compared to conventional technologies[7].

- Our internal initiatives: We have implemented various sustainability measures and initiatives around ESG related themes in our own operations, for our employees and our partners.

In our Sustainability Report, that forms part of our Annual Report, we further elaborate on these and other ESG related aspects, as well as underlying assumptions and methodologies related to the above-mentioned metrics.

Executing on our strategy

NX Filtration’s key strategic themes centre around the roll-out of pilot projects, the expansion of its production capacity and further innovation.

Pilot roll-out

Pilots play an important role in NX Filtration’s commercial roll-out strategy. Pilots range from lab-scale Mexplorer pilots to full-scale (containerised) Mexpert pilots. In 2021, NX Filtration initiated 87 pilot projects compared to 27 in 2020. On 31 December 2021, NX Filtration had 85 pilot systems in its fleet and, to facilitate a growing demand for its pilot systems, NX Filtration is further expanding its fleet of pilot systems. Including outstanding purchase orders for additional pilot systems, NX Filtration is heading towards 111 pilot systems in the short term, therewith reaching the halfway point towards its medium-term objective of 200 pilot systems. We are also broadening our fleet of pilot systems with dedicated systems for the North American and Asian markets, and are working to add larger-scale pilot/demo systems (based on 10 membrane modules) to our fleet.

Capacity expansion

NX Filtration is making further progress on expanding its production capacity. With the addition of a separate facility (at the Josink Esweg in Enschede, the Netherlands) for the production of its membrane modules in the first half-year of 2021, the original facility (at the Institutenweg in Enschede, the Netherlands) was expanded to accommodate a second spinning line for the production of membranes. This second spinning line has been commissioned at the end of 2021, resulting in a combined total capacity of approximately 10,000 membrane modules per year[8] (compared to the capacity of approximately 2,500 membrane modules per year in 2020[9]). Production output is expected to be gradually ramped up during 2022.

In parallel, further progress has been made with the development of a new large-scale manufacturing facility, which is expected to be commissioned at the end of 2023. We secured a 24,000 square meters plot of land at the High Tech Systems Park in Hengelo, the Netherlands, approximately 10 kilometres from the current facilities. We also staffed our project organisation for the construction of our new manufacturing facility, which is responsible for construction, installation and automation. Construction works are expected to start in the second half of 2022. Upon completion, which is expected at the end of 2023, this facility can be expanded to a targeted total capacity of approximately 80,000 membrane modules per year[10].

Innovation

We are convinced that our breakthrough dNF membrane technology will play an important role in addressing global issues which center around water quality and water scarcity. It makes us proud that the breakthrough character of our membranes is also being recognised by various industry observers.

- In August 2021, NX Filtration received the 2021 Frost & Sullivan Global New Product Innovation Award in the water and wastewater treatment membrane industry. Their commentary on this prize included: “Climate change today leads to increasing water scarcity and water contamination. Frost & Sullivan recognises NX Filtration’s direct nanofiltration membranes’ ability to address such challenges. The company displays highly effective and resilient properties that allow users to achieve high selectivity at nanoscale. By utilising NX Filtration’s membrane solutions, companies can achieve higher efficiency in a sustainable process unmatched by the competition.”

- In June 2021, NX Filtration received a distinction from the Global Water Intelligence in the category Breakthrough Technology Company of the Year. Their commentary on our company included: “NX Filtration’s membrane provides a step change in water treatment, disrupting traditional treatment trains such as UF-RO in surface water treatment and wastewater reuse applications.” and “By controlling membrane properties on a nanometre level via polyelectrolyte layers, NX Filtration is uniquely positioned to meet the growing challenge of treating micropollutants in different feedwaters.”

In 2021, we also made great progress on our patent portfolio, through the grants of 10 patents in various countries and through adding 2 new patent family applications to our portfolio. These new patent applications relate to further performance improvements on our dNF technology (‘dNF regeneration’) and new membrane inserts (‘innovative membrane holder’).

Outlook

Boosted by the additional equity capital that NX Filtration raised with its IPO in June 2021, we continue to invest in our strategic priorities in 2022. A further ramp-up of our commercial roll-out program will be enabled by a growing fleet of pilot systems (from 18 at the end of 2020, to 85 at the end of 2021 and anticipated more than 140 at the end of 2022) and an increase in the number of pilot engineers.

With the addition of our second spinning line for the production of dNF membranes, we will unlock further growth opportunities and enable production efficiencies. In 2022, we will also take important steps in the development of our new large-scale production plant, with construction expected to start in the second half of the year. Furthermore, we continue to expand NX Filtration’s organisation, specifically on international sales, pilot engineering, R&D and production personnel.

ESG will remain a key part of our overall mission on which we will not compromise while scaling up. NX Filtration considers high ESG standards of great importance for its long-term success, its workforce, its customers, the environment and society as a whole. The strong growth that NX Filtration is currently experiencing provides many opportunities to organise ESG aspects with the highest standards and impact from the outset. Furthermore, we will follow the development regarding the EU Taxonomy Regulation closely, in particular the details around objectives for which the delegated regulations including the technical screening are still under development.

In 2022, we aim to continue the strong growth of our business and fast-track the roll-out of our strategy. For 2022, we have an outlook on total revenues of €8m to €10m, driven by strong market demand and our expanding global sales presence, enabled by the increase in production capacity. This targeted growth is largely driven by past and ongoing pilot projects that are converting into larger scale projects and by repeat business with our existing (OEM) relationships.We remain fully committed to make an impact based on our mission ‘clean and affordable water for all’, whilst offering strong sustainability benefits to our customers and providing an inspiring working environment for our employees.

[1] Total revenues (defined as Gross income in the Annual Report) includes revenues from sale of goods in the Clean Municipal Water and Sustainable Industrial water business lines and other income

2 Based on NX Filtration’s sales of approximately 1,200 membrane modules (dNF and UF only), multiplied by the expected capacity and lifetime of such modules. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

3 During the deployment of NX Filtration’s membrane modules by avoiding 3.9 million kg of chemicals and saving 49 GWh of energy. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

4 Working capital defined as Inventories plus trade and other receivables minus trade and other payables

5 dNF sales represent approximately 2/3 of total revenues from sale of goods. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

6 Based on NX Filtration’s sales of approximately 1,200 membrane modules (dNF and UF only), multiplied by the expected capacity and lifetime of such modules. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

7 See Sustainability Chapter in the Annual Report for details, assumptions and methodologies

8 Estimation, based on 5-shift production and depending on product mix

9 Theoretical capacity (as the current spinning line is incurring downtime with changes in products being produced and because spinning line is also used for R&D activities), estimation based on 3-shift production and depending on product mix

10 Estimation, based on 5-shift production and depending on product mix

[1] Total revenues (defined as Gross income in the Annual Report) includes revenues from sale of goods in the Clean Municipal Water and Sustainable Industrial water business lines and other income

[2] Based on NX Filtration’s sales of approximately 1,200 membrane modules (dNF and UF only), multiplied by the expected capacity and lifetime of such modules. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

[3] During the deployment of NX Filtration’s membrane modules by avoiding 3.9 million kg of chemicals and saving 49 GWh of energy. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

[4] Working capital defined as Inventories plus trade and other receivables minus trade and other payables

[5] dNF sales represent approximately 2/3 of total revenues from sale of goods. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

[6] Based on NX Filtration’s sales of approximately 1,200 membrane modules (dNF and UF only), multiplied by the expected capacity and lifetime of such modules. See Sustainability Report as part of the Annual Report for details, assumptions and methodologies

[7] See Sustainability Chapter in the Annual Report for details, assumptions and methodologies

[8] Estimation, based on 5-shift production and depending on product mix

[9] Theoretical capacity (as the current spinning line is incurring downtime with changes in products being produced and because spinning line is also used for R&D activities), estimation based on 3-shift production and depending on product mix

[10] Estimation, based on 5-shift production and depending on product mix